A Net 30 invoice template is a document used by businesses to bill clients for goods or services with a payment term of 30 days. A well-designed invoice template can help a business establish a professional image, streamline its invoicing process, and improve its cash flow.

Essential Elements of a Net 30 Invoice Template

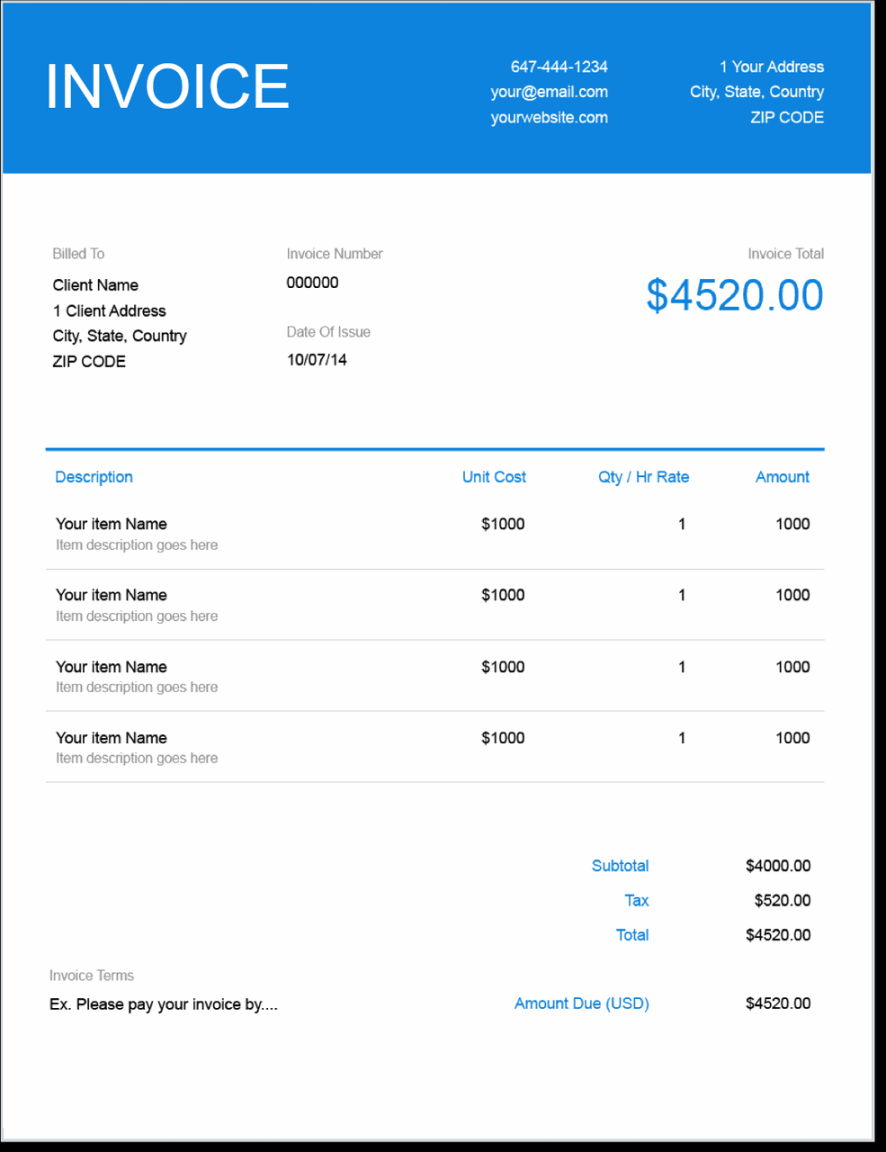

1. Invoice Number: This unique identifier helps track and reference the invoice.

2. Invoice Date: The date the invoice was issued.

3. Due Date: The date by which payment is expected.

4. Client Information: The name, address, and contact information of the client.

5. Business Information: The name, address, and contact information of the business issuing the invoice.

6. Invoice Items: A detailed list of the goods or services provided, including quantity, description, unit price, and total cost.

7. Subtotal: The total cost of the goods or services before taxes or discounts.

8. Taxes: Any applicable sales taxes or other taxes.

9. Discounts: Any discounts or promotions applied to the invoice.

10. Total: The final amount due after taxes and discounts.

11. Payment Terms: A clear statement of the payment terms, including the due date and any late fees or penalties.

12. Payment Methods: The accepted payment methods, such as check, credit Card, or wire transfer.

13. Contact Information: The contact information for any questions or inquiries about the invoice.

Design Elements for a Professional Net 30 Invoice Template

1. Layout: A clean and organized layout with consistent spacing and margins.

2. Font: A professional and easy-to-read font, such as Arial, Helvetica, or Times New Roman.

3. Font Size: A font size that is large enough to be easily read but not so large that it takes up too much space.

4. Color Scheme: A color scheme that is professional and visually appealing. Avoid using too many colors, as this can make the invoice look cluttered.

5. Logo: Include your business logo at the top of the invoice to help establish your brand identity.

6. Header and Footer: Use a header and footer to include your business name, contact information, and invoice number.

7. Branding: Incorporate your branding elements, such as colors, fonts, and imagery, throughout the invoice.

8. White Space: Use white space effectively to create a clean and uncluttered look.

Additional Considerations

Customization: Consider customizing your invoice template to meet the specific needs of your business. For example, you may want to include a message thanking the client for their business or a promotional offer.

By following these guidelines, you can create a professional Net 30 invoice template that will help your business look its best and improve your cash flow.