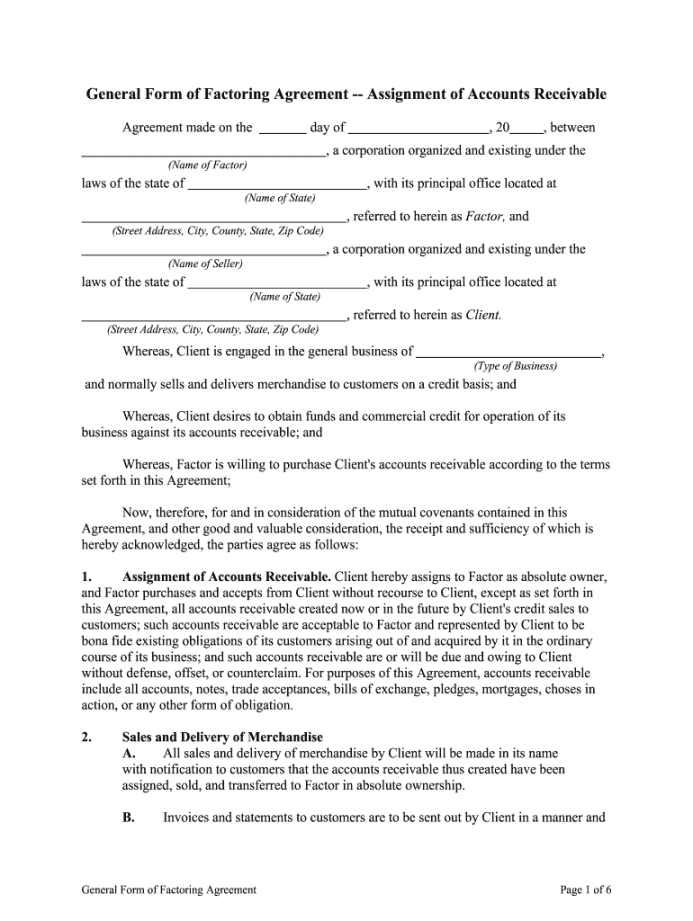

What is an Invoice Discounting Agreement Template?

An Invoice Discounting Agreement Template is a legally binding document that outlines the terms and conditions under which a business can sell its unpaid invoices to a third-party financier, known as a factor. This process, known as invoice discounting, allows businesses to access immediate cash flow by converting their future receivables into upfront funds.

Key Components of an Invoice Discounting Agreement Template

A well-structured Invoice Discounting Agreement Template should include the following essential components:

Parties to the Agreement

Seller: The business that owns the invoices and is seeking to sell them.

Invoice Eligibility Criteria

Type of Invoices: Specify the types of invoices eligible for discounting, such as sales invoices, service invoices, or government invoices.

Discount Rate and Fees

Discount Rate: Clearly state the discount rate that will be applied to the invoice amount.

Security and Collateral

Security: Describe the security measures that will be in place to protect the factor’s investment, such as lien on assets or personal guarantees.

Recourse Provisions

Dispute Resolution

Confidentiality and Governing Law

Confidentiality: Address the confidentiality obligations of both parties to protect sensitive information.

Designing a Professional Invoice Discounting Agreement Template

To create a professional and effective Invoice Discounting Agreement Template, consider the following design elements:

Clear and Concise Language: Use plain language that is easy to understand, avoiding legal jargon whenever possible.

Conclusion

A well-crafted Invoice Discounting Agreement Template is essential for establishing a clear and legally sound relationship between a seller and a factor. By carefully considering the key components and design elements outlined in this guide, you can create a template that effectively protects the interests of both parties and facilitates successful invoice discounting transactions.