Net Present Value (NPV) is a financial metric used to determine the present value of future cash flows. It helps businesses make informed decisions about investments by comparing the initial cost of an investment to the discounted value of its future cash flows. An Excel template can streamline the NPV calculation process and ensure accuracy.

Key Components of a Professional NPV Excel Template

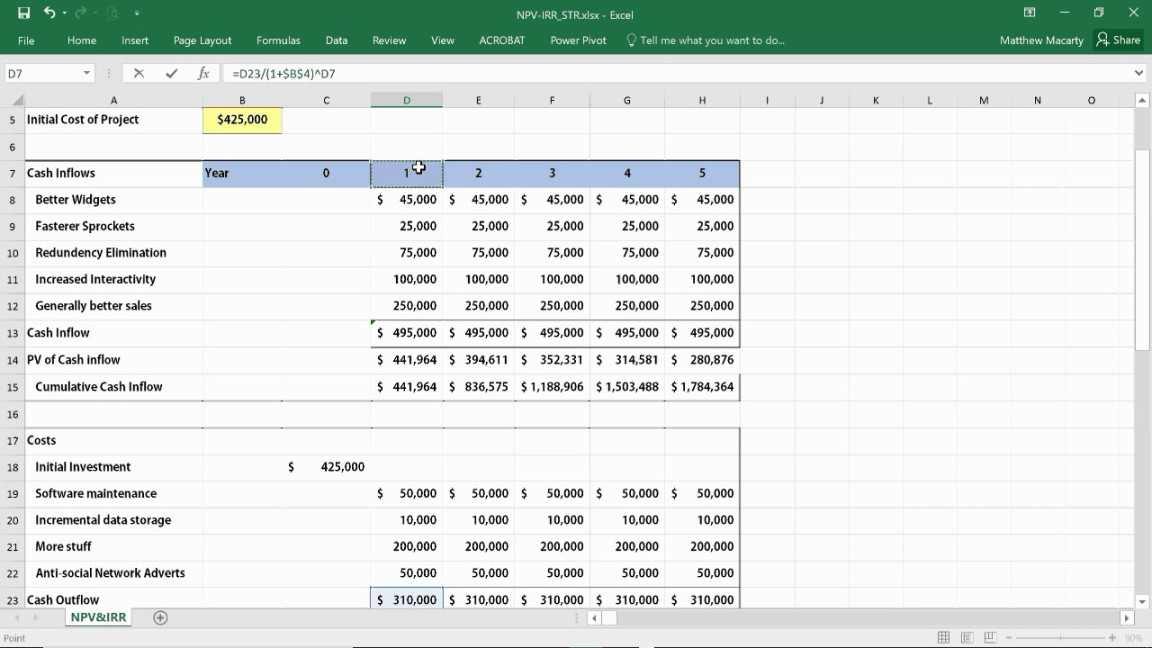

A well-designed NPV Excel template should include the following essential components:

1. Clear and Concise Layout

Use a consistent font and font size throughout the template to maintain a professional appearance.

2. Input Fields

Create input fields for essential data, such as:

3. NPV Calculation

Implement a formula to calculate the NPV based on the input values.

4. Sensitivity Analysis

Include a section for sensitivity analysis to assess how changes in input variables affect the NPV.

5. Visualization

Use charts and graphs to visually represent the NPV calculation and sensitivity analysis results.

6. Comments and Notes

Add comments or notes to explain the formulas, assumptions, or any specific considerations.

7. Formatting and Styling

Apply consistent formatting to enhance the template’s appearance.

Example of a Professional NPV Excel Template Layout

Project Name

Input Data

ItemValue

Initial Investment

Discount Rate

YearCash Flow

1

2

…

NPV Calculation

NPV = …

Sensitivity Analysis

ScenarioDiscount RateNPV

Pessimistic

Base Case

Optimistic

Visualization

[Insert chart or graph here]

Tips for Creating a Professional NPV Excel Template

Keep the template user-friendly by providing clear instructions and explanations.

By following these guidelines, you can create a professional and effective NPV Excel template that will help you make informed investment decisions.