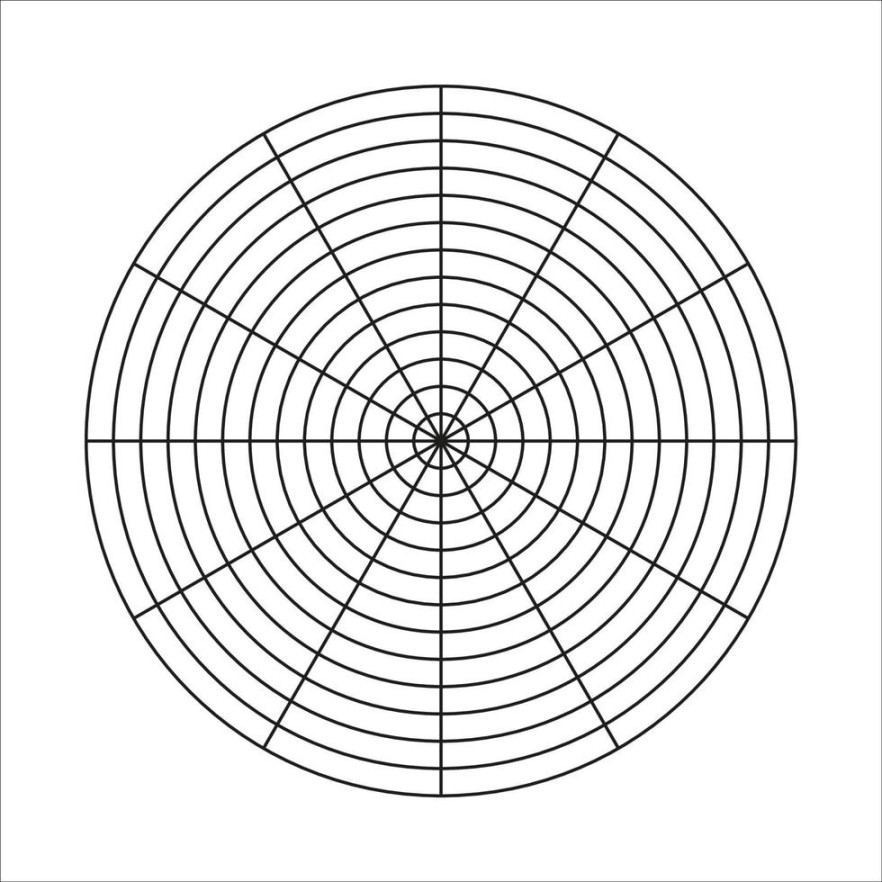

A Wheel of Life Template Blank is a visual tool used for self-assessment and personal development. It represents different life areas as spokes on a wheel, allowing individuals to evaluate their satisfaction level in each area. By visually representing these areas, individuals can identify areas of strength and areas that require more attention.

Key Design Elements for a Professional Wheel of Life Template Blank

To create a Wheel of Life Template Blank that conveys professionalism and trust, it is essential to consider the following design elements:

1. Clear and Consistent Layout:

Wheel Structure: The wheel should be a perfect circle with evenly spaced spokes. This ensures a visually balanced and professional appearance.

2. Professional Typography:

Font Selection: Choose a professional and legible font that is easy to read and complements the overall design. Avoid using overly decorative or difficult-to-read fonts.

3. Color Scheme:

Color Palette: Choose a color palette that is visually appealing and professional. Consider using a combination of neutral colors, such as black, white, and gray, with one or two accent colors to add visual interest.

4. Visual Hierarchy:

Importance of Hierarchy: Use visual hierarchy to guide the viewer’s eye and emphasize the most important elements of the template. This can be achieved through the use of font size, font weight, color, and placement.

5. White Space:

Effective Use of Space: Use white space effectively to create a clean and uncluttered design. Avoid overcrowding the template with too much information or visual elements.

6. Branding Elements:

7. Accessibility:

By carefully considering these design elements, you can create a Wheel of Life Template Blank that is both professional and effective. A well-designed template will not only convey a sense of professionalism but will also be easy to use and understand.